In the fast-paced world of finance, where every second counts and precision is paramount, IT Staff Augmentation has emerged as a financial institution’s secret weapon. This strategic approach is not just about technology; it’s a financial catalyst, propelling institutions toward technological excellence and streamlined operations.

Unleashing the Power of IT Staff Augmentation in Finance

Navigating Finance-specific Challenges

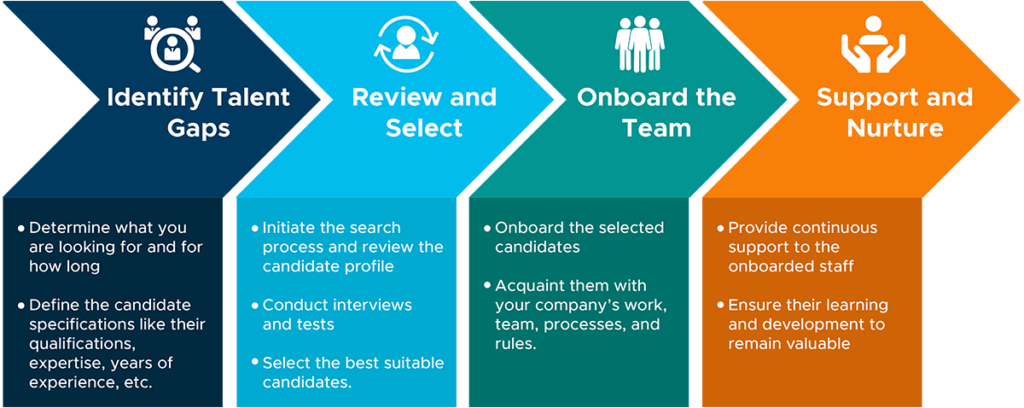

Finance is more than numbers; it’s about managing intricate transactions, ensuring compliance, and safeguarding sensitive information. IT Staff Augmentation in finance goes beyond general IT support. It provides specialists well-versed in financial technologies, risk management, and compliance protocols. This focused expertise is crucial for addressing the unique challenges faced by financial institutions.

Moreover, augmented teams often include professionals with a deep understanding of financial regulations, ensuring that the institution not only complies with existing rules but also anticipates and adapts to regulatory changes proactively.

Enhancing Financial Decision-making with Data Analytics

In the financial realm, data is currency. The augmentation of financial analysts and data scientists amplifies the analytical capabilities of institutions. These experts dive deep into market trends, customer behaviors, and risk assessments, providing actionable insights for informed decision-making.

The focus here is not just on the volume of data but on extracting meaningful financial intelligence. Augmented teams tailor data analytics to financial parameters, offering a competitive edge in a data-driven industry.

Accelerating Technological Excellence in Financial Operations

Real-time Integration for Financial Transactions

Real-time integration is non-negotiable in finance, where transactions happen at lightning speed. IT Staff Augmentation accelerates the integration of cutting-edge technologies like blockchain, ensuring secure and instantaneous financial transactions. This is not merely about adopting buzzworthy technologies but strategically implementing them to enhance the speed and security of financial operations.

The augmentation process involves professionals who understand the intricacies of financial transactions, ensuring a seamless integration that aligns with the precision demanded by the finance industry.

Tailored Solutions for Financial Management

Financial management is more than just number crunching; it’s about optimizing processes, mitigating risks, and maximizing returns. IT Staff Augmentation brings in experts specialized in financial software development and customization. This ensures that financial institutions have tailor-made solutions that align with their specific management needs.

Whether optimizing asset management systems, developing custom financial forecasting tools, or enhancing algorithmic trading platforms, augmented teams focus on solutions that directly impact financial management most efficiently and effectively.

Driving Operational Efficiency in Financial Institutions

Agile Response to Financial Market Dynamics

Financial markets are dynamic, reacting to global events, economic shifts, and market sentiments. The agility afforded by IT Staff Augmentation enables financial institutions to respond swiftly to market dynamics. Whether it’s adjusting trading strategies, scaling operations during peak periods, or restructuring portfolios, augmented teams provide the flexibility required to stay ahead in the financial game.

This agility is finely tuned to financial operations, ensuring that responses are not only quick but also strategically aligned with the financial goals and risk appetite of the institution.

Cost-effective Scalability in the Financial Workforce

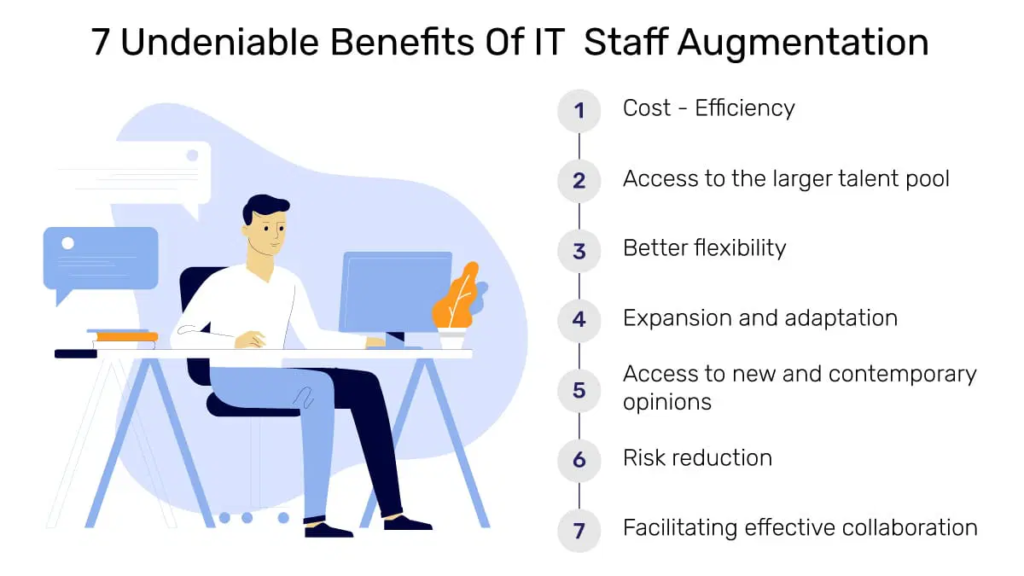

Financial institutions often grapple with the challenge of scaling their workforce to meet project demands without incurring excessive costs. IT Staff Augmentation offers a solution that is not just cost-effective but tailored to the financial landscape. It allows institutions to scale their technology workforce based on project requirements without the long-term commitments and costs associated with traditional hiring.

This scalability is particularly beneficial in financial projects with varying demands, from system upgrades to implementing new financial products. Augmented teams ensure that financial institutions have the right expertise precisely when needed.

Overcoming Financial Security Challenges

Fortifying Financial Cybersecurity

The finance sector is a prime target for cyber threats. IT Staff Augmentation introduces cybersecurity experts specializing in fortifying digital infrastructures specific to financial institutions. This goes beyond generic cybersecurity measures; it involves crafting robust financial cybersecurity strategies, safeguarding transactions, and protecting sensitive financial data from evolving cyber threats.

Augmented teams conduct thorough risk assessments, develop customized cybersecurity protocols, and ensure that financial institutions are not just secure but are perceived as trusted custodians of financial data.

Ensuring Compliance in Financial Operations

Stringent regulatory frameworks define the finance industry. IT Staff Augmentation brings compliance specialists on board, ensuring that financial institutions navigate these complexities seamlessly. These specialists are not only well-versed in existing regulations but are proactive in anticipating changes and aligning the institution with future compliance requirements.

This proactive approach minimizes the risk of non-compliance, which in the financial sector can result in severe consequences. Augmented teams ensure that financial operations not only meet current regulatory standards but are future-proofed against evolving compliance landscapes.

The Future of Finance: IT Staff Augmentation’s Role

As financial landscapes continue to evolve, the role of IT Staff Augmentation becomes even more critical. The future promises advancements such as integrating machine learning for predictive financial analytics, utilizing blockchain for transparent financial transactions, and harnessing the Internet of Things (IoT) for enhanced financial data insights.

Financial institutions that embrace these technological trends through IT Staff Augmentation are not just keeping up; they are shaping the future of finance.