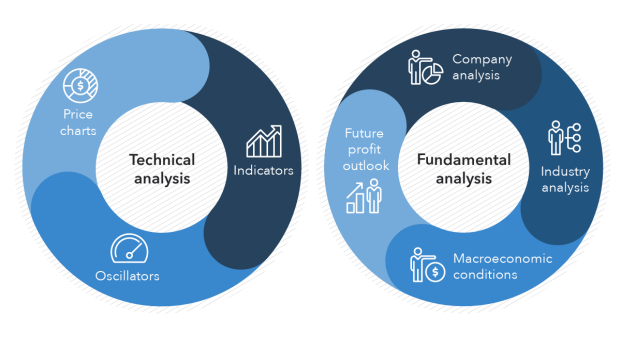

Technical analysis of stocks involves identifying patterns and trends of the stock movement by looking at graphs and charts and then using this data in order to predict the future price movements of the security or stock in question. This discipline of analysis states that the past movements of stock can be a leading indicator for the stock’s movements in the near future. This ideology is contrasting to that of fundamental analysis which believes in analyzing current financial information of the company by calculating key ratios and then using this data to assess the overall financial health of the company and then its long-term outlook.

Technical analysts adjudge technical analysis as a good methodology to identify signals for short term trading not only through historical prices of the stock but also from its correlation with the broader market, the main competitors, and the sector as a whole as well.

This ideology focuses on the fact that the world of financial securities, be it stocks, futures, options, currencies and fixed income and others all depend on the forces of demand and supply which in turn determine its volume, price, and the deviation of the security from its mean.

Technical analysis was first introduced in latter end of the 19th Century by Charles Dow and it involved few signals and patterns but more contributions and years of research into this topic by distinguished researchers has led to several hundreds of signals and patterns that can be derived today for almost any financial security.

Financial analysts often use technical analysis as a compliment to their overall research as it can provide a robust base of historical numerical research support to the vast scope of qualitative historical research. Retail traders, on the other hand, who market securities to clients on behalf of the issuing company, solely focus on the charts and trends to pitch their sales forward.

Technical analysis is traditionally linked to the analysis of historical price changes, however recently, this focus has broadened to include other metrics such as open interest in the case of derivatives and volume in the case of both stocks and other types of financial securities.

Metrics focused on for technical analysis:

- Price trends

- Chart patterns

- Volume

- Momentum

- Oscillators

- Moving averages

- Support levels

- Resistance levels

- Channels

Improve the Communication, Integration & Automation of data flow across your Organization

Calculate your DataOps ROI

Technical analysts use these metrics to develop models and trading systems which makes the process less labor intensive and also improves efficiencies in the long run as more and more stocks and securities are integrated with these systems.

Editorials of Charles Dow state the basic notions of why technical analysis was accepted as a trusted method for stock analysis and prediction; as of today, these notions have adapted with more information and a higher level of complexity to broaden its scope; this can be seen as follows:

- Markets are efficient and discount everything: All aspects of the company’s financial information which is what fundamental analysis is all about is already included or “priced into the stock”. Hence, there is no need to conduct additional fundamental analysis. This known as the EMH or the Efficient Market Hypothesis.

- Trends exist: Technical analysts firmly believe that even if prices move randomly at a certain point in time, the randomness also shows trends over time.

- History repeats itself: This notion states that the massive variations of stock prices repeats itself in time, some of this is partly true as the stock market crashes once every decade due to an unrelated reason each time.

Limitations of Technical Analysis

- The EMH is contradicted by the points of view of the weak form and semi-strong form EMH which state that not all historical information can be a valuable indicator of a financial security’s future movements.

- Many believe that history does not repeat itself when it comes to the stock market and insist on the fact that time evolves constantly while creating new variations in the stock market and thus should be considered as a ‘random walk’.

- Another criticism of this method is that it might help give future predictions sometimes, but it can lead to unpredictable losses as well.

Conclusion

Overall, I believe that the stock market includes both the random walk and the trend at the same time. I think that no analysis can be considered as complete unless various points of view on the type of analysis to be conducted are exhausted. This will enable the analyst to look at information in a different light which in turn can help for insuring any extraordinary changes in the stock market.